Payment trends seem to evolve from year to year as new paying options emerge and trend. As an apparel webstore, you need to find the right payment choices for your shoppers. By limiting your company to one or two payment methods, you are losing potential customers and sales. To successfully increase your purchases, your company should make it as easy as possible to conduct a transaction with customers by offering multiple payment methods. In this guide you’ll learn about the digital payment trends your apparel and accessories eCommerce business needs to offer in order to meet customer expectations and demands.

Peer-to-Peer (P2P) Payments

Within the last couple of years, peer-to-peer (P2P) payments have been increasing in popularity. Even though this payment trend is more common between individuals, some companies have added it to their webstore as an alternative paying method. You’ve no doubt heard of or used one of the most popular peer-to-peer payment apps, PayPal. P2P companies like PayPal give customers a 1-click version of checking-out, facilitating a faster and easier way of completing a purchase. Many shoppers prefer this option because all their card, billing and shipping information is conveniently all in one place.

P2P Combined With Payment Installment Apps

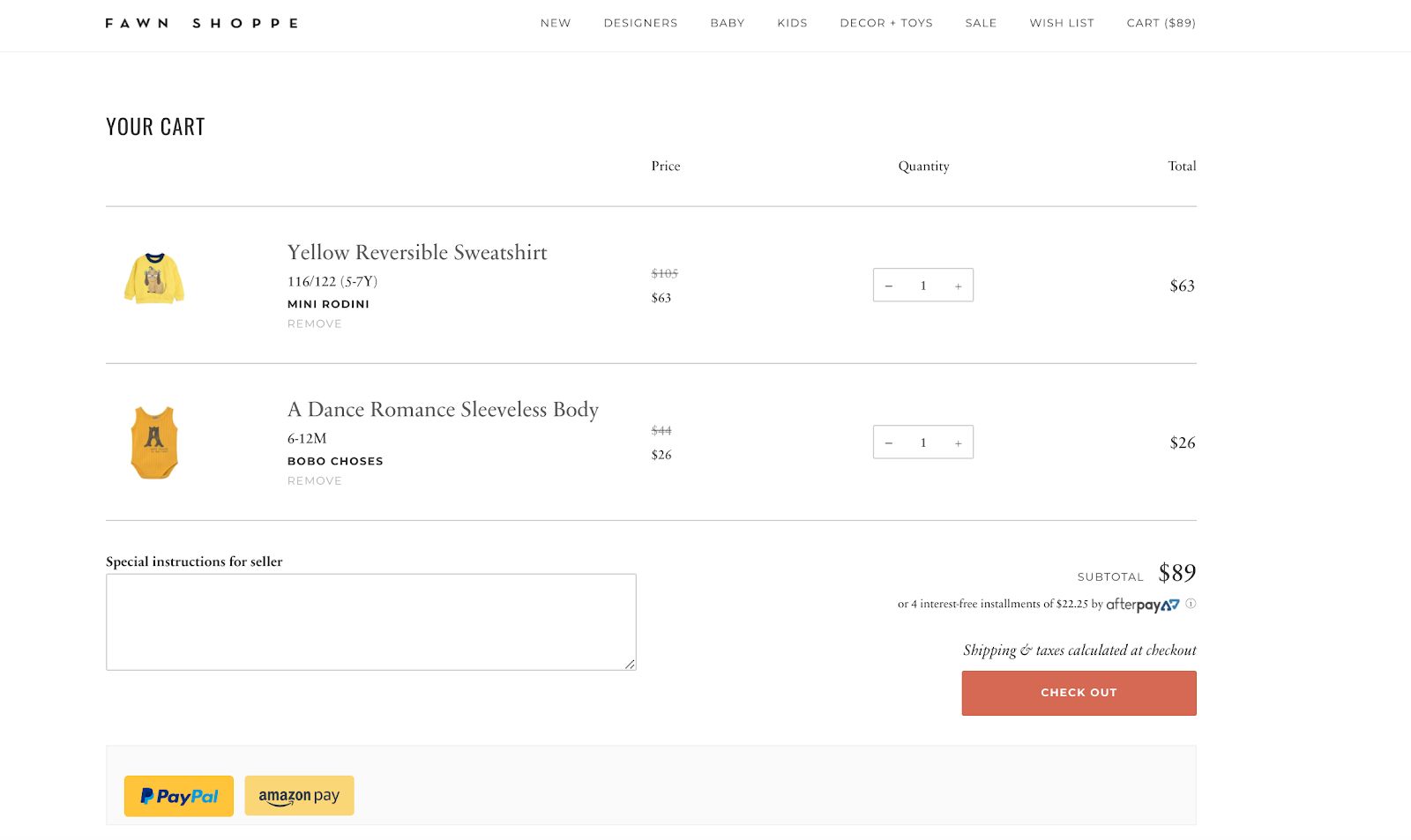

A few years ago payment installment apps like Afterpay and Klarna became a paying option on popular apparel and accessories eCommerce sites. Many apparel webstores allow P2P payments with payment installment apps. Payment installment apps allow the customer to pay for their purchase over a period of time by splitting their total payment into equal parts. Many online users are actively looking for stores that include payment installment apps. Recent studies have shown that shoppers are more likely to purchase and add more items to their cart if payment installments are an option. Customers like the notion of buy now, pay later.

InteractOne worked with the Fawn Shoppe to create an excellent combined peer-to-peer payment system with a payment installment app:

Peer-to-peer payments are not for every company and customer. For example, some sites have experienced issues with hacking associated with their P2P systems. If you do decide to implement peer-to-peer payments, as a company it is your responsibility to build trust and to ensure the safety of your customers’ private information by having proper data privacy. We will discuss later some key elements to look out for when setting up data privacy.

Digital Wallets or Contactless Cards

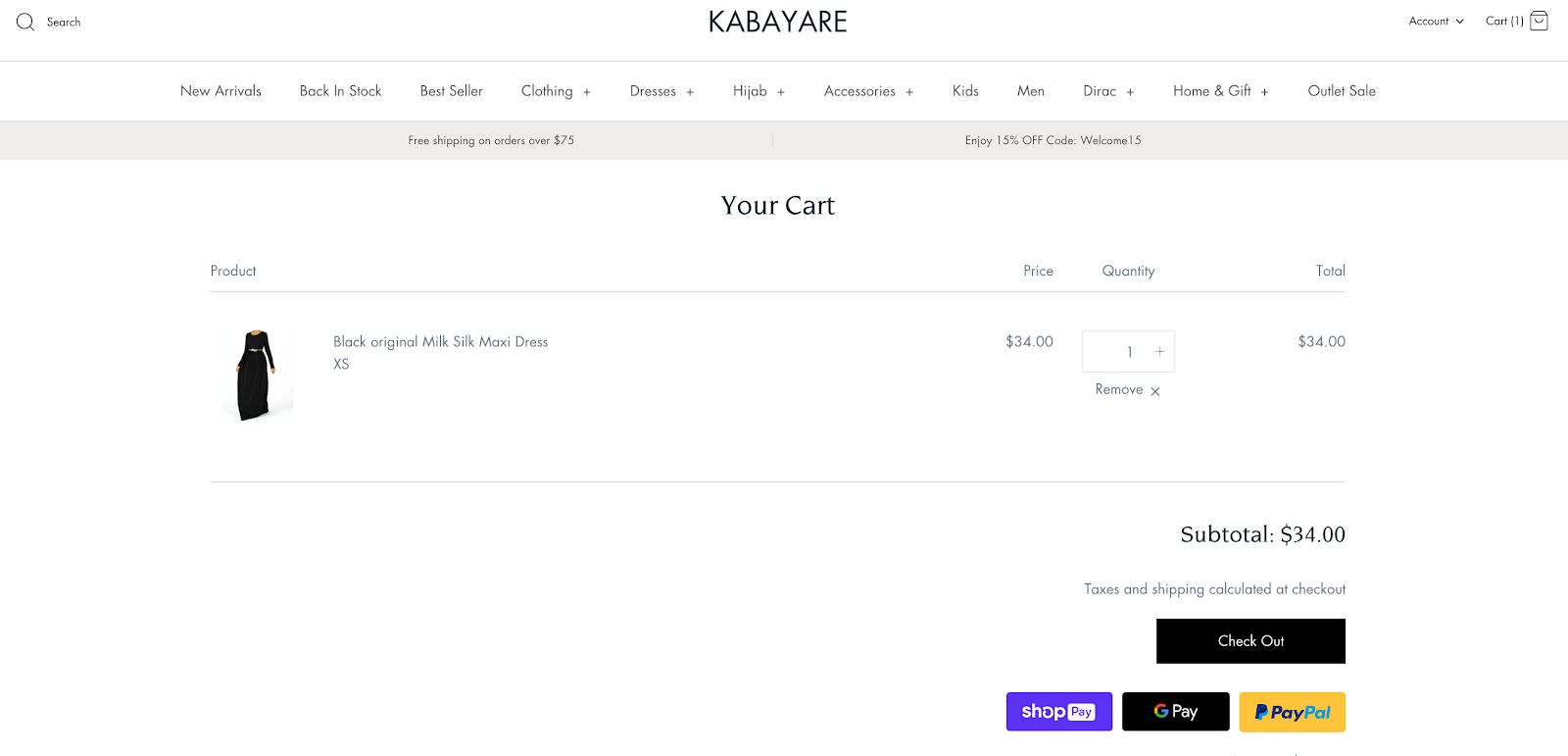

As an eCommerce company, your brand will want to remove as many steps to create an easier and faster check out process for your customers.That’s where digital wallets and contactless cards come to play. Some popular digital wallets and contactless cards on the rise are Apple Wallet, Amazon Pay, Shop Pay and G Pay. These digital wallets and cards are the one-stop app for customers to enter all their card information. Just like peer-to-peer payments, some shoppers prefer this payment method because it is a 1-click check out process. Whenever a customer checks out with a digital wallet or card, the site redirects shoppers to the digital wallet’s app or website to complete the purchase. Once shoppers finish on the digital wallet app or site, they are automatically prompted to finish and review the transaction on the eCommerce site.

Our client, Kabayare Fashion provides a great example of having multiple digital wallets for customers to choose from:

Debit or Credit Cards

The most popular payment method, with 47% of online shoppers claiming it as their preferred payment method, are debit and credit cards. Many shoppers still prefer to manually input their card information into the system because this is the method they are most familiar with it. Debit and credit card companies that most consumers use are VISA, Mastercard, Discover and American Express. It is a given in the minds of customers that your apparel and accessories company will accept debit and credit card payments. These are ‘table stakes’, the bare minimum. If you are hesitant to implement the peer-to-peer payment system or digital wallets and contactless cards, you can always add a payment installment app to go with debit or credit card payments to be able to conduct business with a larger, more diverse audience.

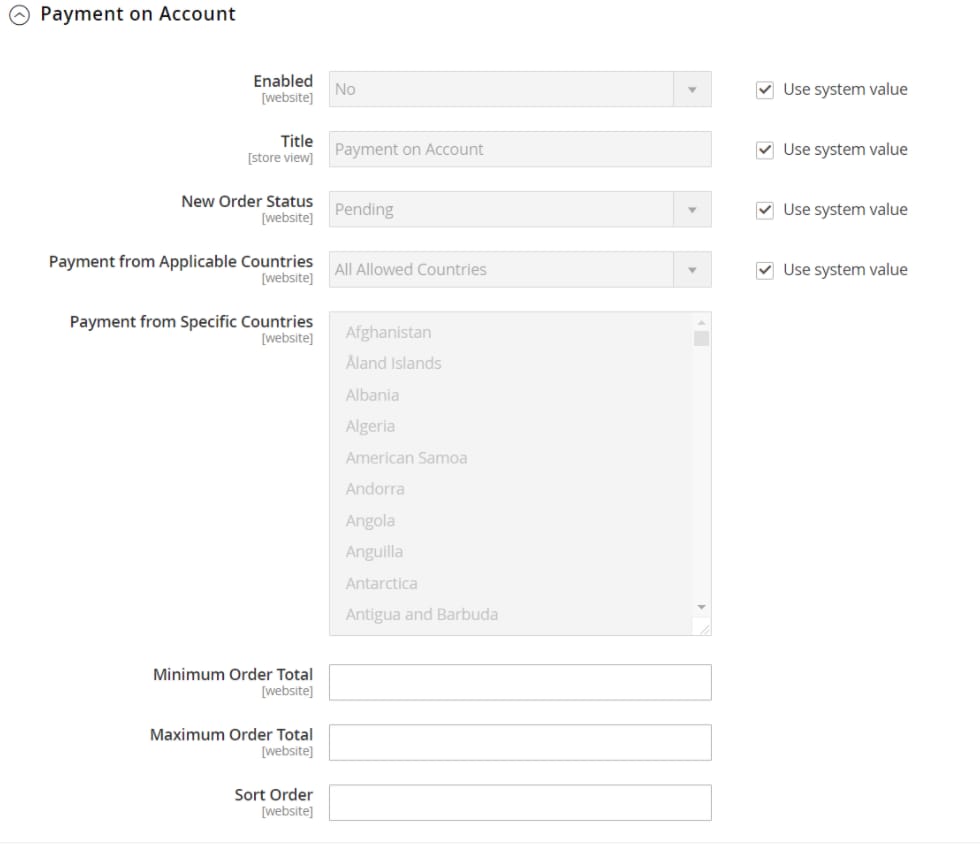

Payment on Account

For apparel and accessories brands that cater to business to business (B2B) stores, Magento Commerce has introduced a Payment on Account feature. This feature is an offline payment method that allows B2B brands to make purchases up to their specified credit limit. Companies can use Payment on Account globally or per account. When you use Payment on Account as your payment method, there will be a message that displays to indicate the status and information of the account like this:

Data Privacy

Customers are looking to purchase from companies that have a large focus on data privacy. Finding a site that has the proper data privacy can be tricky, but many users are avoiding sites that say “not secure” in the URL. Protecting shoppers’ credit cards and shipping information is the most important element for digital payments. If your webstore doesn’t have proper data protection, you will lose a wide range of potential customers. As payment processing and eCommerce technology continue to advance, it is the company’s responsibility to ensure proper data protection from cybercriminals. To protect your customers’ information, follow the EU’s General Data Protection Privacy Act (GDPR) and the Second Payment Services Directive (P2D2.) The GDPR and P2D2 have rules and regulations that govern how companies of all sizes process and transfer an individual’s personal data. Violating the GDPR and P2D2 rules and regulations come with tough penalties like fines up to 4% of the brand’s total global annual turnover.

Mobile-Friendly Payments

In 2019, studies have shown that eCommerce stores have had a 25.5% annual growth rate with it expected to grow to 44% by 2024. With consumers increasingly using their mobile devices to make purchases, your apparel brand needs to optimize its site for mobile-friendly viewing and payments. So how does a company have mobile-friendly payments? There are many ways to optimize user-friendly payments on mobile devices including clear call-to-action buttons, a secure network and auto-fill billing and shipping options. InteractOne can further help you improve your eCommerce’s mobile site or app.

Conclusion

Your company has many digital payment options to choose from, and it is your responsibility as a business to find the best paying method for your customers. If you are unsure of what payment choices work the best for your eCommerce, consider doing a series of A/B tests to help determine the optimal combination of payment options. Many payment companies have free trials and refund policies for companies wanting to expand their paying methods. For help understanding and implementing the best digital payment choices for your company, contact us today.